Evli Fund Management Company

- Nordic boutique fund manager and a leading ESG investment firm

- Approx. €13BN in 26 UCITS funds and several AIF strategies

- Awarded "2023 Best Fund House Overall in Finland" by Morningstar

- True crossover bond portfolios which combine the best of IG and safest HY returns to diversify risk

- Best-in-Class ESG overlay applied effectively across all portfolios to meet the rapidly increasing demand for sustainable investing

- Recognized as "Best Responsible Investment Expertise in Finland" by SFR Institutional Client Survey 11/2022

- Bottom-up active management focused on free cash flow, long-term perspective and an active ESG approach

- Multiple 4 and 5 star ratings and awards from Morningstar

- Numerous awards from Citywire, FundsPeople, Refinitiv Lipper, Quantalys, and Telos

Evli Funds

- Evli Corporate Bond

- Evli Emerging Markets Credit

- Evli Euro Government Bond

- Evli Euro Liquidity

- Evli European High Yield

- Evli European Investment Grade

- Evli Green Corporate Bond

- Evli Nordic Corporate Bond

- Evli Short Corporate Bond

- Evli Target Maturity Nordic Bond 2023

- Evli Finland Select

- Evli Finnish Small Cap

- Evli Sweden Equity Index

- Evli Swedish Small Cap

- Evli Europe

- Evli GEM

- Evli Global

- Evli Global X

- Evli Japan

- Evli North America

- Evli Nordic

- Evli Emerging Frontier

- Evli Equity Factor Europe

- Evli Equity Factor Global

- Evli Equity Factor USA

- Evli Factor Premia

- Evli Finland Mix

- Evli Global Multi Manager 30

- Evli Global Multi Manager 50

Highlights from several Evli Funds

Evli Short Corporate Bond Fund

The Evli Short Corporate Bond fund invests in strong-quality European short-duration corporate bonds. The fund’s target is to achieve the best possible risk-adjusted return over the credit cycle.

- Invests in the European short duration corporate bond market, with access to the stable and strong-yielding Nordic corporate bond market

- Efficient and flexible allocation in the crossover space, combining best yielding IG and safest HY, but with an average portfolio credit rating of BBB- (IG) minimum

- Employs conservative risk controls; no playing with call-dates; 90% of portfolio must have final legal maturity date of max 5 years; and remaining 10% max 8 years

- Top-performing fund in short-, mid-, and long-term horizon in its category: EUR Corporate Bond - Short Term

- Morningstar 2023: ★★★★

- Lipper Fund Awards 2022: Europe - 5 years return

- Lipper Fund Awards 2022: Germany - 5 years return

- Lipper Fund Awards 2022: France - 3 years return

- Excellent track record with the same PM Juhamatti Pukka since strategy inception June 2012

- Fund AUM: €1.5 Billion (2/2023) SFDR classification: Article 8

Evli Nordic Corporate Bond Fund

The Evli Nordic Corporate Bond Fund is a crossover fund investing in Nordic corporate bonds, including IG, HY, rated, and unrated issues. All currency risks are always fully-hedged to EUR and average credit quality is BBB- or higher.

- Unique asset class with constant higher returns from stable and transparent Nordic companies vs similar risk level European corporates

- Roughly half of issuers and one-third of volumes are officially unrated, which creates restrictions for many but opportunities for the rest

- Fund focuses on high but stable return with off-index corporate bond investments from quality issuers, no flirting with default risk

- Stable and high return since strategy inception Q1 2016, beating the EUR IG market returns with clearly shorter duration.

- Portfolio Manager: Jani Kurppa since strategy inception March 2016

- Fund AUM: €875 Million (2/2023)

- ESG and Sustainability criteria deep integrated into initial screening, credit selection and portfolio monitoring.

SFDR classification: Article 8

Evli Nordic Small Cap Equity Funds

The Evli Finnish and Swedish Small Cap funds are concentrated, actively managed funds investing in a large and diverse universe of publicly listed local small and mid-cap companies. Active stock selection with strong conviction is the primary source of outperformance.

Evli Finnish Small Cap Fund

- Focused concentration: 25-30 stocks

- Current strategy since October 2010

- Portfolio Manager: Janne Kujala (18 years)

- 5-year Performance: 9.26% p.a. vs. 7.59% p.a. (Benchmark) 2/2023

- Lipper Fund Awards 2022: Nordic - 10 years return

- Fund AUM: €248 Million (2/2023)

- SFDR classification: Article 8

Evli Swedish Small Cap Fund

- Focused concentration: 30-40 stocks

- Fund launched May 2008

- Portfolio Manager: Janne Kujala (3 years)

- 5-year Performance: 15.27% p.a. vs. 12.73% p.a. (Benchmark) 2/23

- Morningstar: ★★★★

- Fund AUM: SEK 1,478 Million (2/2023)

- SFDR classification: Article 8

Evli Europe Fund (Equities)

The Evli Europe fund is a bottom-up, all-cap equity fund which invests in companies with proven track records of free cash flow generation, strong debt coverage, and cheap stock valuation.

- Conservative, disciplined, and repeatable in-house developed strategy has several margins of safety, e.g., valuing future growth and current cash-assets at zero

- Portfolio is very different from other well-performing peer portfolios – great diversification tool within European equities

- Has beaten the benchmark (MSCI Europe TR) 11 out of 12 calendar years and delivered absolute positive returns 10 out of 12 years.

- Strategy inception April 2010

- Portfolio Manager: Hans-Kristian Sjöholm (12 years)

- Morningstar: ★★★★

- Fund AUM: €553 Million (2/2023)

- SFDR classification: Article 8

Please note: This fund will be soft closed at €1bn and hard closed at €1.25bn

Evli Emerging Frontier Fund

The Evli Emerging Frontier fund is a strong conviction, bottom up fund which invests in cheap, growing-quality companies in a diverse set of Frontier countries only.

- One of the only truly active EM funds, as opposed to the EM index or 95% of all EM funds

- Deep immersion in the markets, with commitment to meet every company before investing

- Focus is on smaller, non-index companies, applying active ownership with friendly shareholder activism

- Due to lack of ESG data, the fund takes an evidence-based approach to ESG

- Fund launched October 2013

- Morningstar 2023: ★★★★★

- 3-year Return: 20.63% (annualized) 2/2023

- Fund AUM: €147 Million (2/2023)

- SFDR classification: Article 8

Evli’s Outstanding ESG Approach

Evli wants to grow its clients’ wealth in a responsible manner, hence responsibility is integrated into all Evli’s investment strategies and operations. In 2010 Evlisigned the UN's Principles for Responsible Investment (PRI) and joined Finsif, Finland’s Sustainable Investment Forum. Evli has been an investor member of the CDP (Carbon Disclosure Project) since 2007. Evli established its Responsible Investment team in 2015, integrated first external ESG database (MSCI ESG) into its in-house database in 2016, and launched the first separate ESG Reports for its funds in 2017. In 2021, Evli was awarded the “Responsible Investment Award” for best expertise in responsible investing (ESG) in its home market Finland, one of the most advanced markets in the world on ESG issues. In November 2022, Evli was awarded the "Responsible Investment Award" for the best responsible investment (ESG) expertise in Finland in the SFR Insitutional Client Survey.

Principles for Responsible Investment

ESG reports for Evli's funds are available: www.evli.com/esg-reports

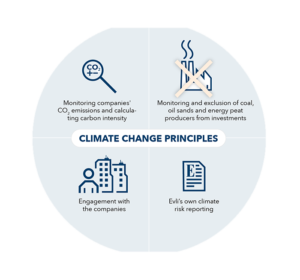

Climate Change Principles

Evli publishes the carbon footprint of its equity and fixed income funds and, in 2020, reported the first TCFD climate risk report.

ESG is at the core of Evli’s strategy. Evli aims to be carbon neutral by 2050 at the latest and has set concrete interim targets.

For more information on Evli, please visit www.evli.com.

The Cardinal Partners Global, S.à.r.l.

11 A Rue Jean Pierre Kommes

L-6988 Hostert, Niederanven

Luxembourg

The Cardinal Partners Global, LLC

114 Stockton Blvd.

Sea Girt, NJ 08750

U.S.A.